BTC Price Prediction: 50% Rally Potential as Technicals and Macro Align

#BTC

- Technical Strength: Price above key MAs with expanding Bollinger Bands

- Institutional Demand: Pension funds and whales accumulating positions

- Regulatory Support: Crypto-friendly Fed appointments and mining exemptions

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Dominate

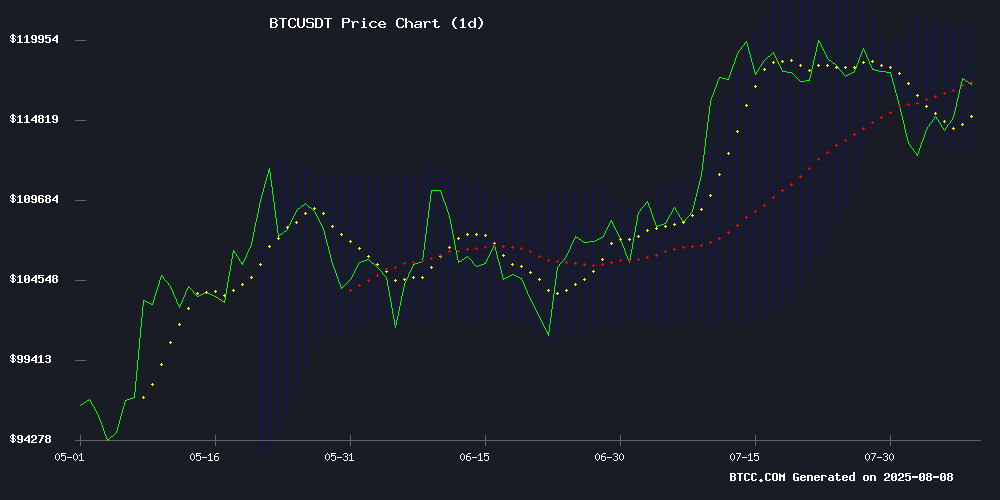

BTCC financial analyst Mia notes that BTC is currently trading at, slightly above its 20-day moving average (116,737.87). The MACD histogram shows bullish momentum at, while Bollinger Bands indicate a stable range (Upper: 120,773.35, Lower: 112,702.39). "The price holding above the middle band suggests consolidation before potential upside," Mia observes.

Macro Tailwinds Fuel Bitcoin Optimism

Mia highlights multiple bullish catalysts:

- Trump's Fed appointment (pro-crypto economist)

- Institutional adoption ($11.3M ARKB investment)

- Mining sector resilience (tariff exemptions)

Factors Influencing BTC’s Price

BTC Mining Industry Unfazed by New Trump Tariffs Amid Chipmaker Exemptions

Bitcoin mining equipment manufacturers remain insulated from the latest round of U.S. semiconductor tariffs, as industry giants TSMC and Samsung secured exemptions through their American production facilities. Taiwan and South Korean officials confirmed the waivers for their respective chipmakers, which supply ASICs to major mining firms like Bitmain and Bitdeer.

Bitdeer revealed its ongoing partnership with TSMC for ASIC production and plans to establish U.S.-based miner assembly within a year. The broader crypto market showed minimal reaction to the tariff announcement, reflecting confidence in the mining sector's supply chain resilience.

Michigan Pension Fund Ramps Up Bitcoin ETF Exposure with $11.3M ARKB Bet

The State of Michigan Retirement System has significantly increased its stake in the ARK 21Shares Bitcoin ETF (ARKB), now holding approximately 300,000 shares worth $11.3 million. This marks a near-tripling of its previous position, signaling growing institutional confidence in Bitcoin as a long-term asset.

ARKB, one of the first SEC-approved spot Bitcoin ETFs, provides regulated exposure to BTC price movements without direct cryptocurrency ownership. The pension fund's move reflects a broader trend of traditional finance embracing crypto through compliant instruments.

Bitcoin Rises Following Trump's Appointment of Bitcoin-Friendly Economist to Federal Reserve

Bitcoin surged 2% to surpass $117,500 after former President Donald Trump nominated Stephen Miran, a known Bitcoin advocate, for a seat on the Federal Reserve Board. Miran, who served in the Treasury Department during Trump's first administration, has publicly endorsed Bitcoin multiple times, signaling a potential shift toward looser monetary policy.

Market analysts interpret Miran's appointment as a dovish move, aligning with Trump's preference for easier Fed policy. Greg Magadini of Amberdata noted, "He's expected to be dovish, which is what Trump wants." However, some warn that this could risk eroding the Fed's credibility, drawing parallels to 1970s-era inflation.

The nomination comes as Bitcoin recovers from recent volatility, with traders betting on a more crypto-friendly Fed under Miran's influence. His tenure would extend through January 2026, pending Senate confirmation.

Mint Miner Emerges as Top Bitcoin Cloud Mining Platform in 2025 with $8,000 Daily Earnings Potential

Bitcoin cloud mining has solidified its position as the go-to method for passive crypto income in 2025, with Mint Miner leading the charge. The platform's AI-driven scheduling system and green energy infrastructure set a new industry standard, offering users seamless access to mining rewards without hardware requirements.

Mint Miner distinguishes itself through crypto-native architecture, supporting multiple currencies while delivering instant settlements. Its combination of technical sophistication and environmental consciousness appeals to both retail and institutional participants seeking exposure to Bitcoin's upside without operational complexities.

Bitcoin Long-Term Holders Cash In $1B+ Profits Amid Neutral Market Sentiment

Bitcoin's midweek trading saw a rare exodus of long-term holders, with over $1 billion in realized profits hitting the market. Glassnode data reveals 34% came from addresses holding BTC for 7-10 years - coins originally acquired during the 2015-2018 cycle when prices swung from $172 to $20,000. These veteran investors liquidated $365 million, while 1-2 year holders sold $93 million worth.

The profit-taking coincides with brewing macroeconomic tensions. Former President Trump's proposed 21% tariff hike on Southeast Asian mining equipment threatens to disrupt supply chains. Market participants now watch whether this HODLer sell-off signals cyclical top formation or mere portfolio rebalancing ahead of potential volatility.

Winklevoss Twins Invest Bitcoin in Trump-Linked Crypto Mining Firm

Gemini founders and Bitcoin billionaires Cameron and Tyler Winklevoss have invested an undisclosed amount of BTC in American Bitcoin Corp., a mining company tied to Donald Trump's sons. The private placement was oversubscribed, with the twins opting to contribute Bitcoin rather than cash.

American Bitcoin Corp. emerged this year through a merger with Gryphon Digital Mining Inc. and has already acquired $2 billion worth of Bitcoin. The firm, backed by Eric Trump and Donald Trump Jr., announced plans for a Nasdaq listing in May via a merger with Gryphon.

Hut 8 CEO Asher Genoot revealed the investment during an earnings call, though neither the Winklevoss brothers nor Genoot disclosed the exact BTC amount. The move signals continued institutional interest in Bitcoin's infrastructure amid growing political acceptance of cryptocurrency.

Bitcoin Flashes Bullish Pattern as Analysts Eye 50% Rally Potential

Bitcoin surged past $116,800 amid growing institutional confidence and robust technical signals. The cryptocurrency's ability to hold the $112,000 support level while forming higher lows suggests accumulating bullish momentum. Trading volume has increased notably on upward price movements, reinforcing buyer dominance.

A decisive breakout above $117,000 resistance could confirm the next leg of the rally, with technical charts mirroring historical patterns that preceded major upside moves. The 4-hour timeframe shows particularly strong momentum, with a potential path toward $118,500 if current levels hold.

Bitcoin Whale Moves $349 Million in BTC After 10-Year Slumber

A dormant Bitcoin whale resurfaced on Thursday, transferring 3,000 BTC worth approximately $349 million after a decade of inactivity. Blockchain data revealed the movement of 100 BTC from 30 legacy addresses to newly created ones, though the motive behind the transaction remains unclear.

The event marks the latest in a series of awakenings among long-term holders. Bitcoin's price, currently hovering around $117,435, has faced resistance breaking the $115,000 threshold this month despite a 2% uptick following positive industry developments.

This follows last month's headline-grabbing transfer of 80,000 BTC (valued at $9 billion then) by another whale after 14 years of dormancy. While initial transactions puzzled analysts, institutional firm Galaxy later confirmed executing the sale on behalf of a client.

U.S. President Donald Trump Appoints Stephen Moran as a Fed Board Member: Crypto Extends Bull Rally

President Donald Trump has nominated Dr. Stephen Moran, former Chairman of the Council of Economic Advisors, to the Federal Reserve Board, replacing Adriana Kugler. Moran’s appointment, effective until January 2026, signals continuity in economic policy as Trump searches for a permanent Fed chair. A Harvard-trained economist, Moran brings deep expertise from his tenure in Trump’s first administration.

Bitcoin and the broader crypto market surged on the news, mirroring gold’s bullish momentum. The rally suggests growing institutional confidence in digital assets as macroeconomic policies evolve. Analysts speculate this could mark the beginning of a sustained crypto uptrend.

Is BTC a good investment?

Mia presents a data-driven case for BTC investment:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +0.05% | Bullish momentum |

| MACD | 965.13 | Strong upward trend |

| Institutional Flow | $11.3M+ | Growing adoption |

"With technicals confirming institutional demand and favorable policy shifts, BTC presents asymmetric upside potential," she concludes.

MACD bullish crossover

Institutional accumulation

Regulatory tailwinds